Maximizing ROI in Bahamas Real Estate

Maximizing ROI in Bahamas Real Estate:

A Comprehensive Guide

Introduction

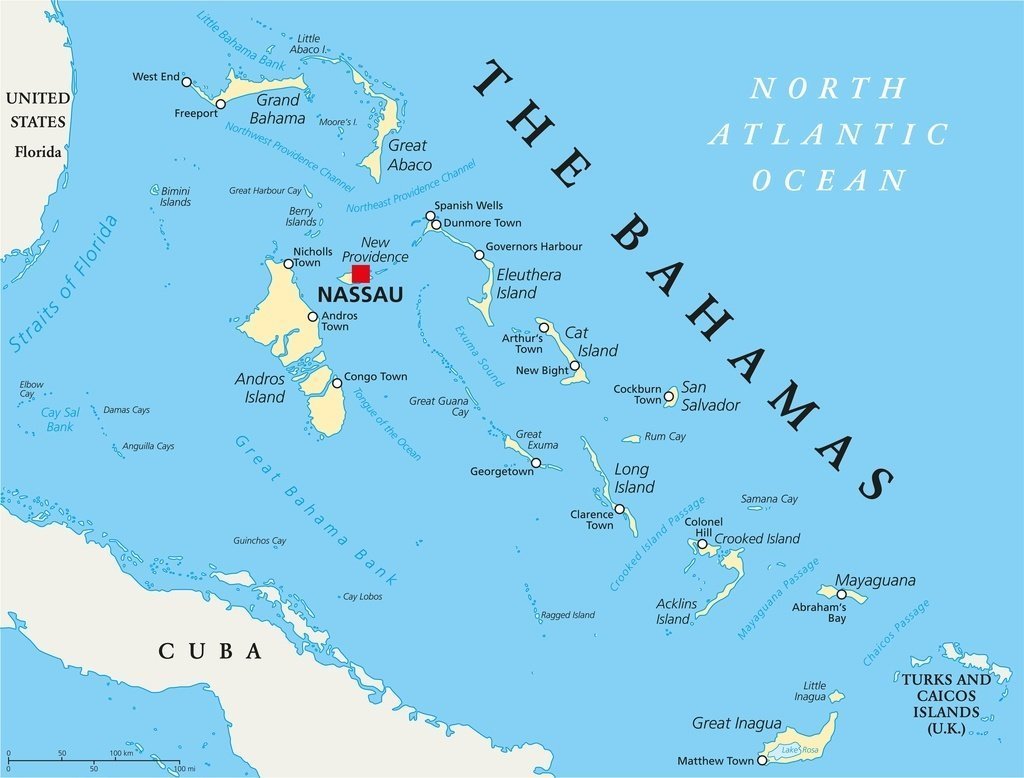

The attractiveness of The Bahamas as a nation of seven hundred islands and cays continues to evolve among the residents and international visitors; its main attraction is its natural beauty and year-round tropical climate.

A tourism-driven economy and favorable tax environment, together with a stable system of government, offer a satisfactory level of safety for real estate investors.

Its proximity to the United States mainland and good flight connections into the rest of north central and south America make it convenient for business meetings or leisure; access to Europe via London brings the old world to the North Atlantic Ocean at only a few hours away.

For decades, the Bahamas lured real estate investors to its shores. Diligent property developers found the enchanting seashores to be perfect spots on which to build multimillion-dollar accommodations offered to an international market seeking to own a piece of paradise.

From the early sixties, the landscape of architecture design underwent notable changes where conservative spaces reminiscent of the Victorian time slowly transformed into more modern, carefree, well-lit spaces influenced by a combination of the austere and a sense of freedom painted against the turquoise-colored water and white sandy beaches.

The old English flair brought over to the islands that became a unique flavor. This uniqueness was interpreted rightly by a Canadian land developer by the name of E. P. Taylor, who in the mid-sixties saw incredible potential on a mass piece of land full of shrubbery located on the western side of the island of New Providence.

By the late seventies, this out-of-the-way development was managing to attract other snowbirds to invest in what became a real estate phenomenon in terms of return on investment ROI. A canal-front vacant lot sold by the developer in the late nineteen seventy-eight for US dollars seventy-eight thousand would resell developed for US dollars one million eight hundred thousand. A vacant lot within an inland section of the same community that sold for US dollars forty thousand would resell developed for US dollars one million three hundred ten years later. This sale could have sold for more, but the owner experienced financial difficulties, opening an advantageous opportunity for the happy investor. These prices were considered excellent investment returns at the time.

There were other properties of similar value and returns. The more word of mouth that got out to the market, the more demand grew for these properties; it was a clear indication that with the right combination of supply and demand, the right investors would come. And they did. That same canal-front home can now be offered to the market for six million plus. This Bahamas real estate phenomenon is Lyford Cay.

From the 1960s to today, other property developers have fallen under the Bahamas charming potential for investing, and many more investors make these islands their primary home, vacation home, or hideaway retreat as tourists or permanent residents.

Understanding the Market

Research and trends. Staying informed about the good areas of Bahamas real estate to invest in is now possible due to the internet and technology. This is true also when feet are on the ground walking through the islands, discovering all sorts of places from the undeveloped to the local neighborhoods to the reserved but more demanding clientele. Talking with residents at pubs or restaurants, real estate offices, or others could be a more fun and effective means of staying informed, or a conversation with us as your Bahamas realtor could be the beginning of a long, productive friendship.

Tourism and economic factors. Take, for example, how tourism, the number one industry in the Bahamas, influences property demand, rental income, and overall market stability. There is much room for growth in these areas of development. The intricacy is finding the balance to achieve a well-laid housing project to attract the younger professionals at competitive prices or build communities for the high-end clientele. It does not have to be either, or because the potential for increased demand can still be created.

- Location, Location, Location.

The prime real estate areas are found on the island of New Providence, in which the capital city of Nassau is located; next to it is the island of Paradise, connected to Nassau by two bridges: the City of Freeport on the island of Grand Bahama; the island of Abaco and cays; and Exuma and cays.

Emerging Locations. Other islands like Eleuthera, Inagua, Long Island, and the Berry Islands, while they may be less known, may still offer great relocation sites at more accessible prices. These may offer a higher ROI due to lower initial costs and growing popularity. Although it must be said that prices vary throughout the Bahamas as it would be dependent on the objective for the investment.

- Property Types and Investment Strategies

Vacation Rentals: Consider investment opportunities for the potential of short-term rentals, especially in touristy areas. However, do not neglect the hidden gems on the out islands to attract repeat returning visitors who prefer a quieter rest. Examine the ROI potential.

Long-Term Rentals: Consider the benefits of steady, long-term rental income in residential zones.

Luxury vs. Affordable Properties: Compare the investment potential of luxury homes versus more affordable properties.

- Legal Considerations and Cost

Buying Process: The steps for purchasing property in the Bahamas, including legal requirements and necessary documentation, can always be verified and assisted on a case-by-case basis. Here is a highlight, however brief.

Tax Advantages: The tax benefits for property owners in the Bahamas include no capital gains or inheritance taxes.

Hidden Costs: Additional costs such as property management fees, maintenance, and insurance would need to be factored in annually.

- Financing and Leverage

Financing Options: Available mortgage options for foreign investors may be best served for consideration through offshore financing institutions, as these may offer more favorable loan terms.

Leverage: Leveraging financing can enhance ROI but also increase risk.

- Maximizing Rental Income

Property Management: The role of professional property management in optimizing rental income and maintaining property value undoubtedly pays back as property maintenance demands are met onsite.

Marketing Strategies: Effective marketing tactics to attract high-quality tenants or vacationers must be part of the strategy with consideration of cost and return.

Seasonal Demand: Capitalize on peak tourism seasons to maximize rental rates. Learn and become knowledgeable about how these cycles apply to the Bahamas location and target those markets looking for the warmth and leisure it offers.

- Exit Strategy and Long-Term Planning

Appreciation Potential: Historical property appreciation rates continue to impress investors over the years, influenced by predictable year-round tropical weather and a stable system of government in an economy highly dependent on imports but where steady is the norm.

Resale Strategy: Selling property at a profit may be determined by several factors, including urgency of sale, timing, and market conditions; however, these factors are subject to change based on the focus of your market area, property type, and price range.

Diversification: Ideally, diversifying investments within the real estate sector to mitigate risk should be pursued. This would be true for Bahamas real estate and elsewhere.

In conclusion, here are the main strategies for maximizing return on investment ROI in Bahamas real estate that should be considered:

- Understanding the Market

- Location

- Property Types and Investment Strategies

- Legal Considerations and Cost

- Financing and Leverage

- Maximizing Rental Income

- Exit Strategy and Long-Term Planning

And remember: conduct thorough research, seek expert advice, and stay informed about market trends before investing.

Resources:

Priscilla Hudson Broker Agent

Realty One Group Nassau

Our real estate agency is here to assist you in finding homes and properties for sale and investing in the Bahamas.

We work with reputable legal and financial advisors.