How to Buy a Home in the Bahamas

How to Buy a Home in the Bahamas

The Bahamas is a dream destination for many, with its clear waters, year-round sunshine, and relaxed island lifestyle. Whether you are looking for a vacation retreat, a retirement home, or an investment property, buying a home in the Bahamas can be a rewarding experience. However, the process involves specific legal and financial steps that potential buyers should understand. This guide provides a step-by-step overview of how to buy a home in the Bahamas.

1. Understand the Real Estate Market in the Bahamas

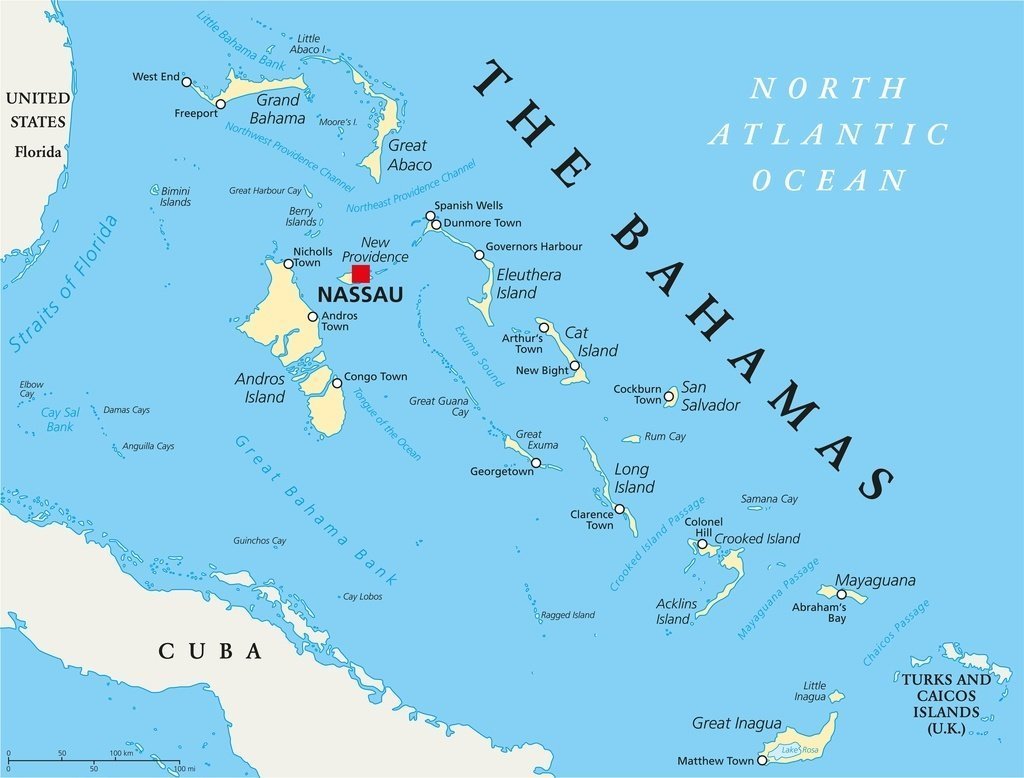

Before purchasing a home, it is essential to familiarize yourself with the Bahamian real estate market. Property prices can vary significantly depending on location, property type, and amenities. Some of the most popular islands for homebuyers include:

- New Providence (Nassau): The economic hub with the most amenities. It is also the closest major Bahamian island to the United States, located approximately 180 miles southeast of Miami, Florida. Direct flights from major U.S. cities make it accessible for American buyers.

- Paradise Island: Known for luxury resorts and high-end properties.

- Grand Bahama: Offers more affordable real estate options.

- Exuma & The Abacos: Ideal for private, tranquil living with stunning beaches.

- Eleuthera: A favorite for those seeking a laid-back, tropical paradise.

- The Berry Islands (including Bimini): These islands are known for their proximity to Florida, with Bimini being just 50 miles from Miami. This makes them a popular choice for boaters and weekend retreats, offering a mix of luxury properties and more secluded beachfront homes

2. Determine Your Budget and Financing Options

Property prices in the Bahamas range from affordable homes to multi-million-dollar luxury estates. Consider these key financial aspects:

- Cash vs. Mortgage: Foreign buyers can obtain mortgages from Bahamian banks, though they may require a substantial down payment (30-40%).

- Property Taxes: The Bahamas does not impose capital gains tax, inheritance tax, or corporate tax, but there is a property tax system based on property value.

- Legal and Closing Costs: Buyers should budget for legal fees (2.5% of the purchase price) and stamp duty (ranging from 2.5% to 10% depending on the property value)

3. Work with a Licensed Real Estate Agent

A licensed Bahamian real estate agent can be a valuable resource in helping you navigate the market. Agents are familiar with local regulations and due diligence requirements for foreign investors, property values, and available listings. The Bahamas Real Estate Association (BREA) regulates real estate professionals and ensures compliance with local laws.

4. Choose the Right Property

Once you have set your budget and found a dependable real estate agent, begin searching for a property that meets your needs. Consider:

- Location: Proximity to beaches, airports, and essential amenities.

- Infrastructure: Availability of utilities such as water, electricity, and internet.

- Resale Value: Areas with high rental demand tend to have better long-term investment potential.

- Community and Lifestyle: Some areas offer a quiet, secluded retreat, while others provide a vibrant social scene.

5. Make an Offer and Sign a Sales Agreement

Once you have chosen a property, your real estate agent will help you make an offer. If the seller accepts, you will sign a legally binding sales agreement. At this stage, you typically pay a deposit (usually 10% of the purchase price) to secure the property.

6. Obtain Legal Assistance and Conduct Due Diligence

Hiring a Bahamian attorney is crucial for conducting due diligence on the property. Your attorney will:

- Verify the property title to ensure no liens or disputes.

- Ensure compliance with Bahamian property laws.

- Prepare and review all legal documents.

7. Secure Permits and Approvals

Foreigners can purchase property in the Bahamas, but there are certain legal requirements:

- For properties under 5 acres, no government approval is needed, but the purchase must be registered with the Bahamas Investment Authority (BIA).

- For properties over 5 acres or commercial investments, you must obtain a government permit.

- For rental properties: If you plan to rent your home, you need a business license from the Bahamian government.

8. Restrictions and Requirements

Foreign ownership of property in the Bahamas comes with specific restrictions and legal requirements. Understanding these rules is crucial to navigating the market successfully.

- Designated Areas for Foreign Buyers: Foreign nationals are encouraged to purchase properties in designated areas, often within resort developments or specific investment zones. While foreigners can buy property outside these zones, additional approvals may be required.

- Government Approval Process: Buyers must apply for government approval through the Investment Board, which reviews applications to ensure compliance with Bahamian regulations. This process may introduce delays, making it essential to prepare all required documentation and understand the associated fees.

- Mortgage Challenges: Foreign investors seeking mortgages may face different lending requirements compared to Bahamian residents. Banks typically require higher down payments (30-40%) and may impose stricter financial scrutiny.

By understanding these restrictions and requirements, buyers can better manage their expectations and reduce potential challenges in securing property in the Bahamas.

9. Close the Sale

Once all legal checks and approvals are completed, the last step is closing the sale. The balance of the purchase price is paid, and ownership is transferred to you. The property is then registered in your name, and you will receive your deed.

10. Pay Taxes and Fees

There are a few additional costs to bear in mind when buying property:

- Stamp Duty: A one-time tax shared between the buyer and seller.

- Legal Fees: Typically, around 2.5% of the property price.

- Annual Property Tax: Ranges from 0.75% to 2% depending on property value.

11. Enjoy Your New Home!

After completing the purchase, you can begin settling into your new home in the Bahamas. Whether it is a permanent move, a vacation retreat, or an investment property, owning a home in this tropical paradise is a rewarding experience.

Final Tips

- Always work with licensed professionals, including real estate agents, attorneys, and financial advisors.

- Consider visiting the property in person before making a purchase.

- Be mindful of hurricane risks and insurance requirements.

- Research visa and residency options if you plan to live in the Bahamas full-time.

By following these steps, you can successfully navigate the process of buying a home in the Bahamas and enjoy the island lifestyle of which you have always dreamed.

Resources:

Priscilla Hudson Broker Agent

Realty One Group Nassau

Our real estate agency is here to assist you in finding homes and properties for sale and investing in the Bahamas.

We work with reputable legal and financial advisors.